Introduction

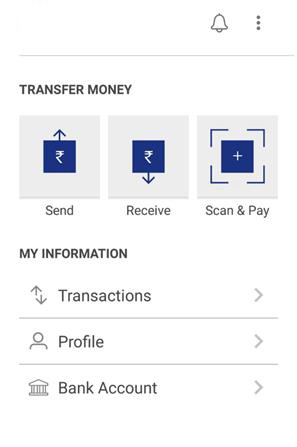

Bharat Interface for Money (BHIM) is an app that lets you make simple, easy and quick payment transactions using Unified Payments Interface (UPI). You can easily make direct bank to bank payments instantly and collect money using just Mobile number or Payment address. Service available are as follows

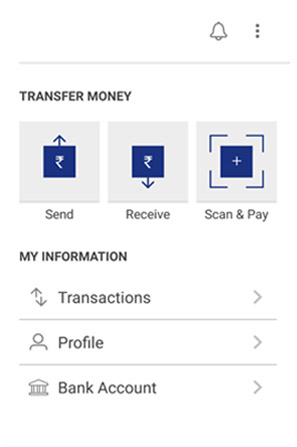

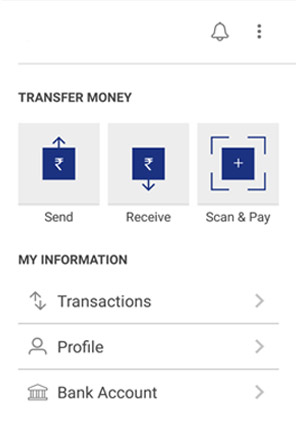

- Send Money – Using this option, you can send money to anyone using Virtual Payment Address (VPA), Account no & IFSC and QR Scan.

- Request Money – Using this option, you can collect money by entering Virtual Payment Address (VPA). Additionally through BHIM App, one can also transfer money using Mobile No. (Mobile No should be registered with BHIM or *99# and account should be linked).

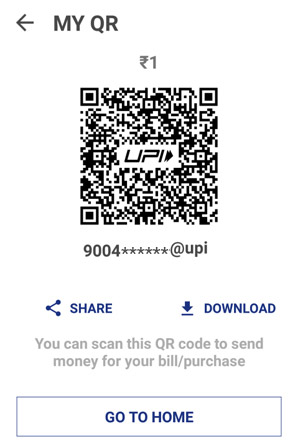

- Scan & Pay- Using this option, you can pay by scanning the QR code through Scan & Pay & generate your QR option is also present.

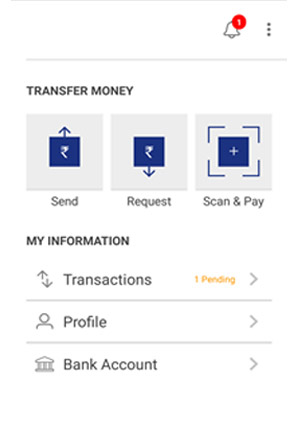

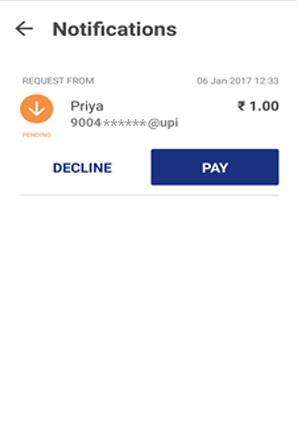

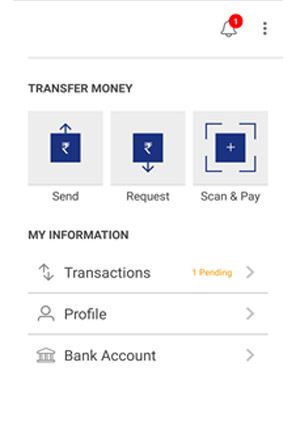

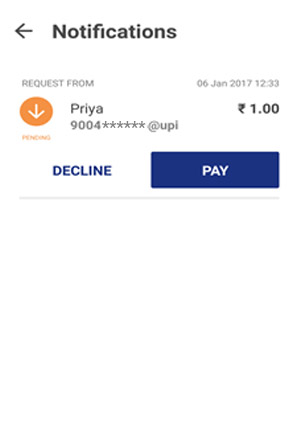

- Transactions – Using this option, you can check transaction history and also pending UPI collect requests (if any) and approve or reject. You can raise complaint for the declined transactions by clicking on Report issue in transactions.

- Profile – Using this option, you can view the static QR code and Payment addresses created. You can also share the QR code through various messenger applications like WhatsApp, Email etc. available on phone and can also download the QR code.

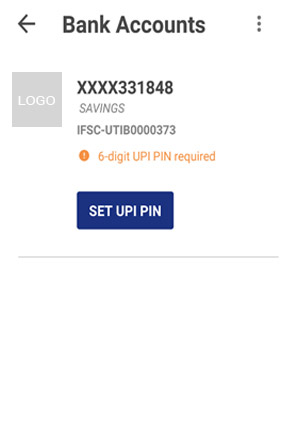

- Bank Account – Using this Option, you can see the bank account linked with your BHIM App and its PIN status. You can set/change your UPI PIN. You can also change the bank account linked with BHIM App by clicking Change account provided in Menu. Also you can check Balance of your linked Bank Account by clicking “REQUEST BALANCE”.

How to access BHIM

First Time User

- Step 1 : Download and Install BHIM app from Google Play store

- Step 2 : Select your preferred language.

- Step 3 : Select SIM which has mobile number that is registered with bank CBS

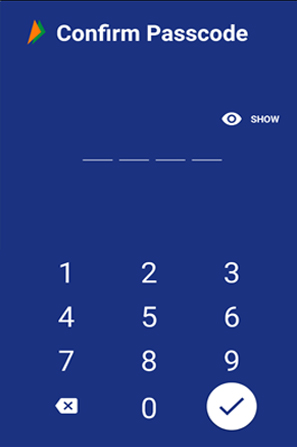

- Step 4 : Login by setting a 4 digit application password

- Step 5 : Link your bank accounts using bank account option

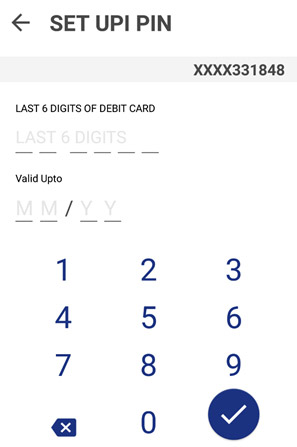

- Step 6 : Set your UPI PIN by providing last 6 digits of debit card and expiry date of debit card

- Step 7 : Visit Profile option and set virtual payment address (VPA)s (2 virtual payment address (VPA)s are allowed per user 1. mobno@upi, 2. name@upi)

- Step 8 : Set one virtual payment address (VPA) as a primary virtual payment address (VPA) ( Ex. name@upican be primary virtual payment address (VPA) making it easy to share with others)

- Step 9 : QR code feature is available, by using Scan and Pay option send and collect money anytime

- Step 10 : Send, receive, collect money using virtual payment address (VPA), Account number + IFSC ,Scan and Pay option

How to send Money on BHIM

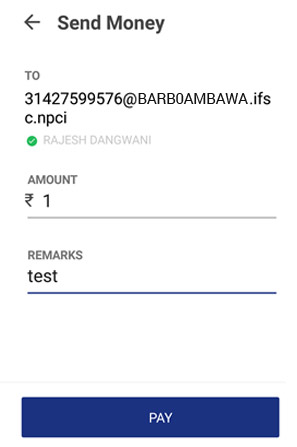

Using Virtual Payment Address (VPA)

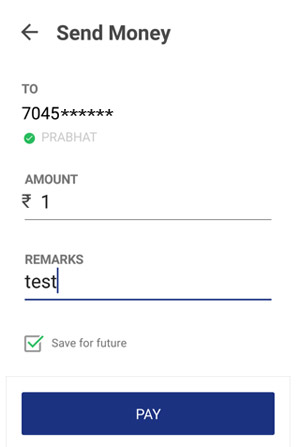

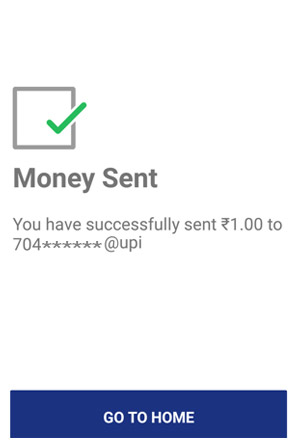

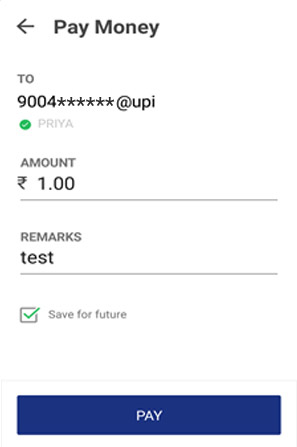

- Customer opens the app on his/her smartphone and enters the app login passcode.

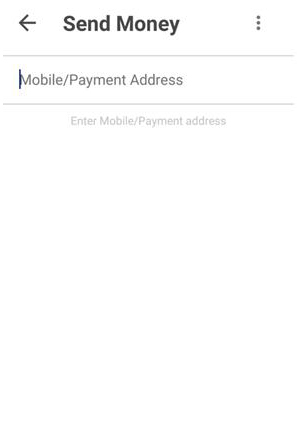

- Select Send Money Option.

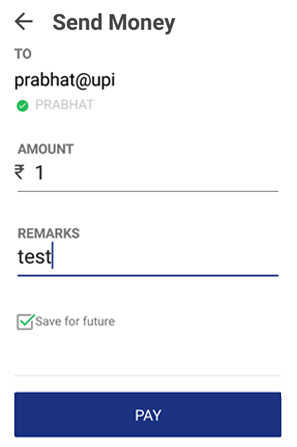

- Customer initiates a SEND request

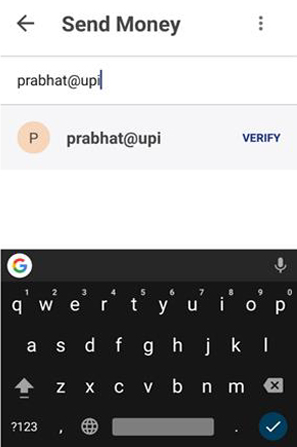

- Customer enters the virtual payment address (VPA) & clicks on verify to check the name of the payee.

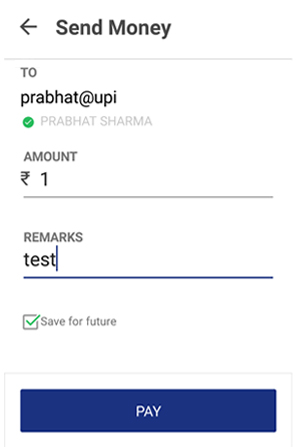

- Name of the PAYEE is fetched from the Bank CBS. Customer enters the amount and remarks for the transaction and Clicks on PAY.

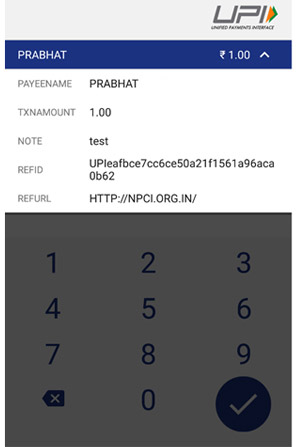

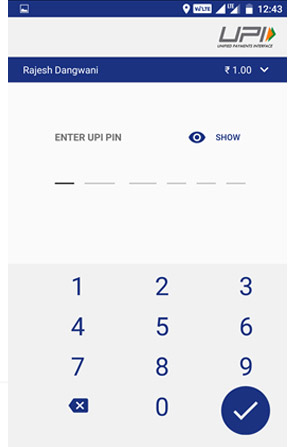

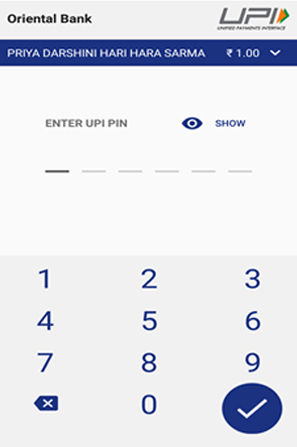

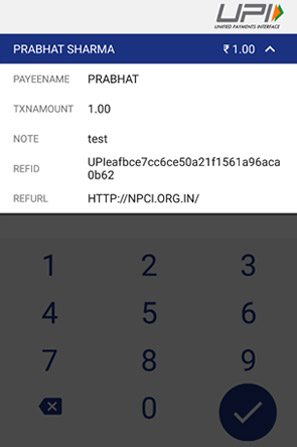

- Customer can also check the details of the transaction from the dropdown in the UPI PIN entry page

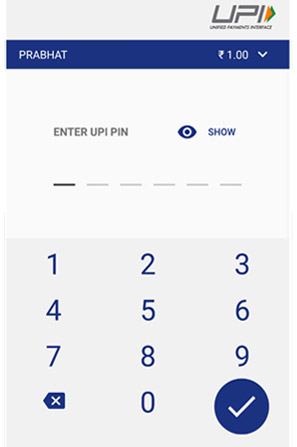

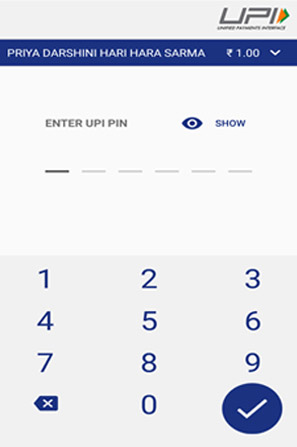

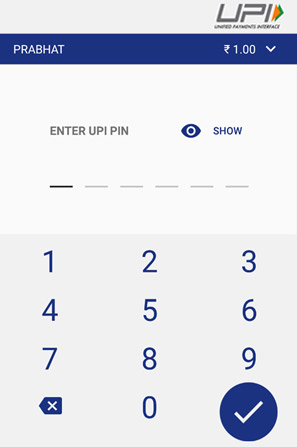

- UPI PIN entry page opens where customer enters his UPI PIN

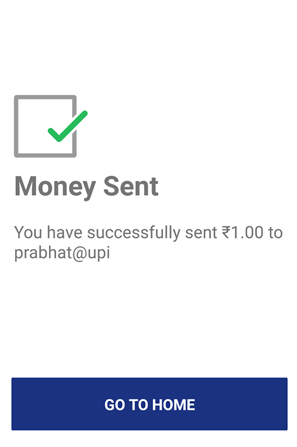

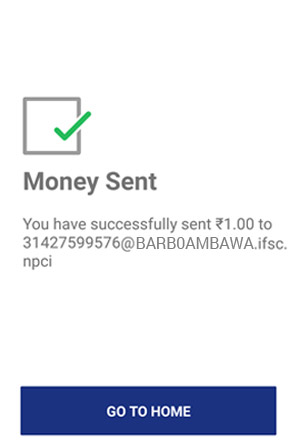

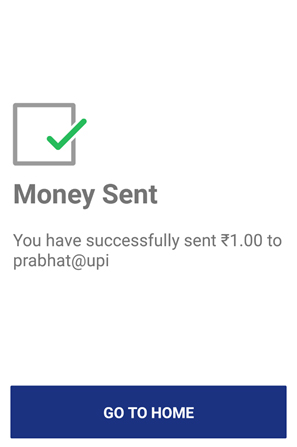

- Confirmation of money sent is shown to the customer

- Customer gets a notification for the success of the transaction from the app.

Using Mobile Number

- Customer opens the app on his/her smartphone and enters the app login passcode.

- Select Send Money Option.

- Customer initiates a SEND request

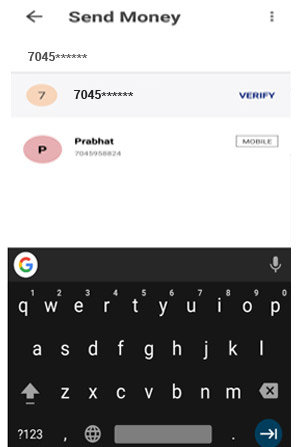

- Customer enters the mobile number & clicks on verify to check the name of the payee.

- Name of the PAYEE is fetched, if user is registered on *99#/BHIM. Customer enters the amount and remarks for the transaction and Clicks on PAY.

- Customer can also check the details of the transaction from the dropdown in the UPI PIN entry page

- UPI PIN entry page opens where customer enters his UPI PIN

- Confirmation of money sent is shown to the customer

- Customer gets a notification for the success of the transaction from the app.

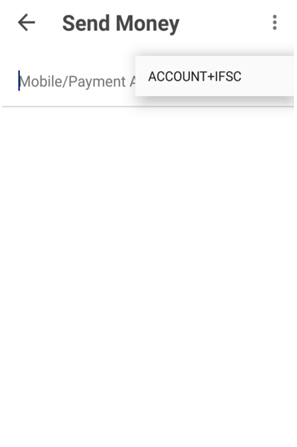

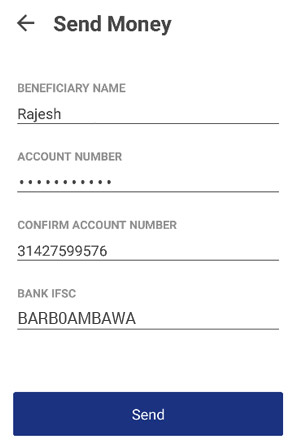

Using Account No & IFSC

- Customer opens the app on his/her smartphone and enters the app login passcode.

- Select Send Money Option.

- Customer select the option present on top right corner to pay through account no & IFSC.

- Customer enters the Account No & IFSC & clicks on verify to check the name of the payee.

- Name of the PAYEE is fetched from the Bank CBS. Customer enters the amount and remarks for the transaction and Clicks on PAY.

- Customer can also check the details of the transaction from the dropdown in the UPI PIN entry page

- UPI PIN entry page opens where customer enters his UPI PIN

- Confirmation of money sent is shown to the customer

- Customer gets a notification for the success of the transaction from the app.

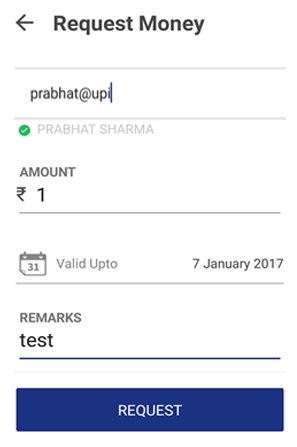

How to collect money on BHIM

Using Virtual Payment Address (VPA)

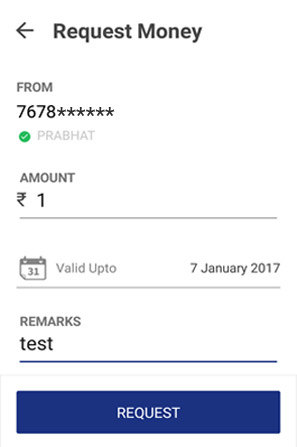

- Customer opens the app and enters the app login and passcode. Select Receive Money Option and initiates a request transaction.

- Customer enters virtual payment address (VPA) to collect money and clicks on verify to check the name of payer

- PAYER name is shown to the requester and he enters the amount and remarks

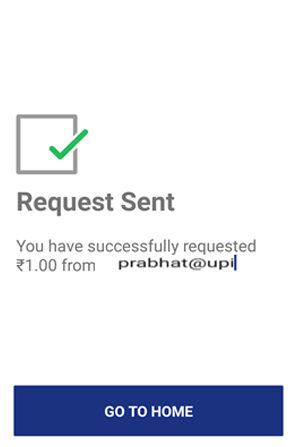

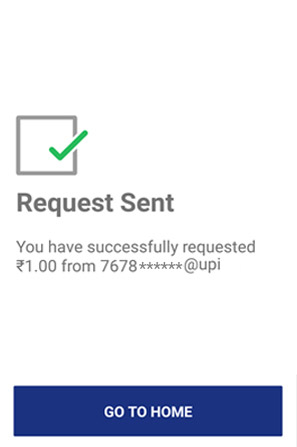

- Confirmation of Request Sent is given to the initiator.

- Initiator is notified once PAYER accepts the request for money

Using Mobile number

- Customer opens the app and enters the app login and passcode. Select Receive Money Option and initiates a request transaction.

- Customer enters Mobile no to collect money and clicks on verify to check the name of payer

- PAYER name is shown to the requester and he enters the amount and remarks

- Confirmation of Request Sent is given to the initiator.

- Initiator is notified once PAYER accepts the request for money

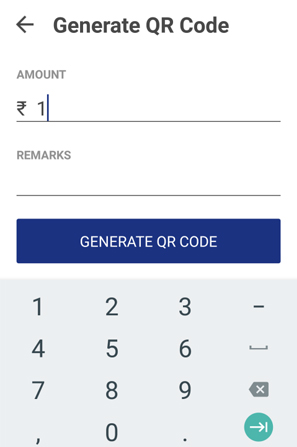

Using generated QR code (Dynamic)

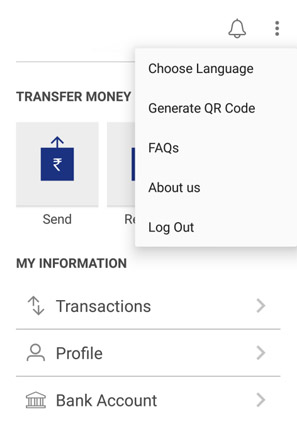

- Choose the option to generate the QR code present at the top right corner on the home page.

- Generate the QR code and share the QR code for requesting Money.

How to Scan & Pay

- Customer opens the app on his/her smartphone and enters the app login passcode.

- Customer can also choose to Scan & Pay through a QR.

- Application opens a QR scanner which then populates the details like any other PAY transaction and on entering the UPI PIN, transaction can be completed

- Name of the PAYEE is fetched from the Bank CBS. Customer enters the amount and remarks for the transaction and Clicks on PAY.

- UPI PIN entry page opens where customer enters his UPI PIN

- Confirmation of money sent is shown to the customer.

- Customer gets a notification for the success of the transaction from the app

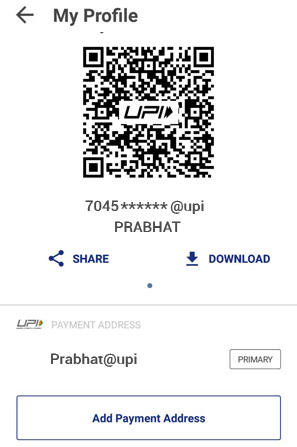

My Profile (Static)

- In the My Profile section, customer has an already available QR generated with the primary UPI handle which can be directly shared from the application.

- There are 2 VIRTUAL PAYMENT ADDRESS (VPA)s shown 1. With mobilenumber@upi 2. name@upi.

- The customer can choose his desired VIRTUAL PAYMENT ADDRESS (VPA) as the default or Primary VIRTUAL PAYMENT ADDRESS (VPA)

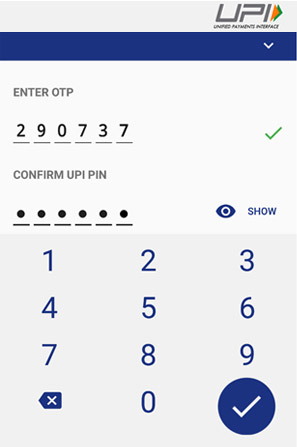

How to Reset/Change UPI PIN on BHIM

- Choose Bank account option.

- Select on Reset UPI PIN.

- For setting UPI PIN, customer enters the last six digits and the expiry date of the card

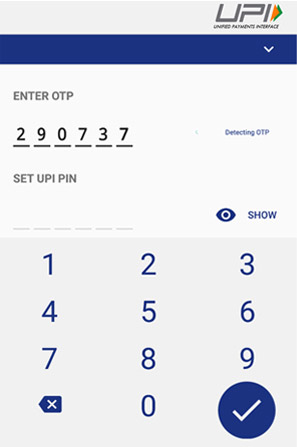

- Bank OTP is requested and auto detected within the app. The customer enters his/her new UPI PIN

- Customer reconfirms the UPI PIN

- UPI PIN registration success message is shown

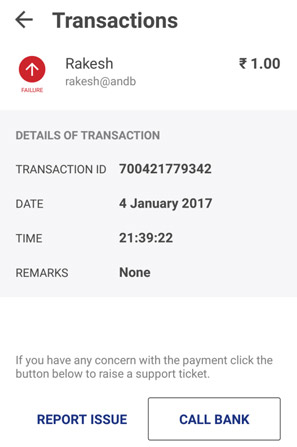

How to Raise complain on BHIM

- Choose Transaction option on Home Page.

- Select the declined transactions (highlighted in Red).

- Click on report issue or call bank.

Unique features of BHIM

- QR code based scan & pay option available, Generate your own QR code option is also available

- Option to save your beneficiaries for future references

- Access transaction history and Request Balance anytime

- Create, reset or change UPI PIN

- Report Issue and call Bank facilities are given to lodge complaints

- FAQ section is created in the app to answer all the queries reg. BHIM

- Available in 2 languages English and Hindi

Benefits of BHIM

- Single App for sending and receiving money and making merchant payments

- Go cashless anywhere anytime

- Added security of Single click 2 factor authentication

- Seamless money collection through single identifiers, reduced risks, real time

- Mobile no. or Name used to create VIRTUAL PAYMENT ADDRESS (VPA)

- Best answer to Cash on Delivery hassle

- Send and collect using VIRTUAL PAYMENT ADDRESS (VPA) or A/c no & IFSC

- Payments through single app in your favourite language.

- 24X7, 365 days instantaneous money transfer

Transfer Limits

- Maximum limit per transaction is Rs. 10,000 per transaction

- Maximum limit per day is Rs. 20,000

There is limit of 20 transactions per account per bank.

Charges for using BHIM

- For Smart Phones with Internet option BHIM can be executed via the app (available in Play store and coming soon for iPhone app store), whereas for feature phones, BHIM can be executed via phone dialer using *99# option.

- The charges for BHIM is one time hard binding SMS charges depending on the mobile operator ( Standard SMS charges of your operator).For *99# the charges are Rs.0.50/- for one transaction. It is up to bank’s discretion to levy any charges on the customers for using BHIM. From NPCI there are no charges levied upon the customer.